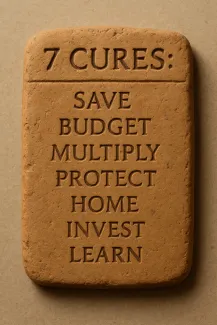

The 7 Cures from The Richest Man in Bablyon

Maybe not your typical book review! And I’ve never written one, so …..

But I wanted to take the 7 Cures from The Richest Man in Bablyon and give some modern habits and systems that can help guide your finances. As with anything, and the book really drives this message home, it takes hard work, good work, and discipline to make it happen.

Initially published in 1926, the book follows the story of Arkad in the ancient city of Babylon. Babylon was believed to be the most advanced, richest city in the ancient world. The richest man guides Arkad through the 7 Cures, and other stories on how to build wealth, but ultimately a happy life. I won’t cover it all, but a quick read for those interested.

Cure 1: Start Thy Purse to Fattening

In Today’s Terms: Pay yourself First

Save at least 10% of your earnings, which is your money! Have a separate savings account for this money, don’t touch it, and automate the deposits if you can.

Cure 2: Control Thy Expenditures

In Today’s Terms: Set a budget, stick to it

Use one of many apps to track your spending. Cut costs where you can, review subscriptions, and don’t forget to plan in your savings. Here is where short-term enjoyment versus long-term happiness should help you stay disciplined.

Cure 3: Make Thy Gold Multiply

In Today’s Terms: Put your money to work

Be wise in your investments. Keep the money that you earned from that money also working for you, compounding.

Cure 4: Guard Thy Treasures from Loss

In Today’s Terms: Preserve your earnings

Keep 3-6 months of savings as an emergency fund. Stick to investments you understand. Are you protected by the right type and amount of insurance? Don’t make emotional decisions.

Cure 5: Make Thy Dwelling a Profitable Investment

In Today’s Terms: Take care of your home

You own an asset, make it something you are proud of. Make sure you keep its value by keeping it updated.

Cure 6: Ensure a Future Income

In Today’s Terms: Ensure a Future Income

Automate your retirement savings, diversify your investments, and track your progress towards your retirement.

Cure 7: Increase Thy Ability to Earn

In Today’s Terms: Keep Learning and Growing

Build your skills, review your goals and business plan, increase your network. Your single best income source is you!

What I love most is the confidence that comes with a disciplined approach to your finances. You don’t have to conquer them all now, prioritize a couple now, and use that to build on in the future.

The last thing I will leave you with is probably my favorite thing from the book. And that is enjoying your work. We don’t love everything about our jobs; there is always something we don’t like. But what we can love is how proud we feel when we work hard, and do good work.

If you would like a 7 Cure’s Checklist, send me an email at nelson@talluscapital.com.

Next month: Retirement Plans for your Business

Investing involves risk including the loss of principal. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.